As the price of raw materials and labour rises, our annual survey of the UK manufacturing industry in association with IMechE reveals a new focus on cost: both as a major concern for businesses, and as a potential bottleneck in their adoption of new technologies.

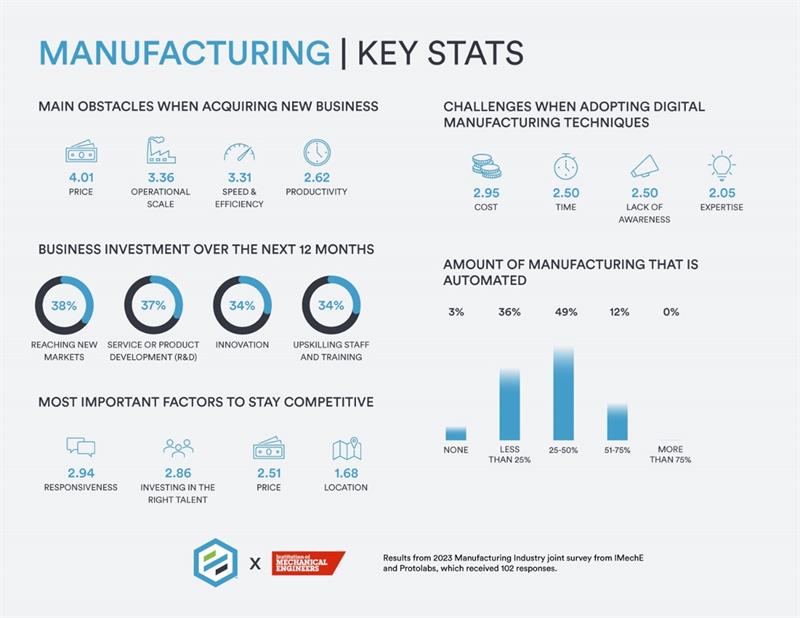

Nearly 40% of 102 industry leaders surveyed selected cost as the greatest challenge faced by UK companies when it comes to adopting digital manufacturing techniques, ahead of time, lack of awareness and expertise. In 2022, speed and efficiency were cited as the biggest obstacle to acquiring new business. In 2023, it’s price.

Unfortunately, interest in sustainability seems to have collapsed as cost pressures bite – when asked what the most important area of investment would be over the next 12 months, only 18.81% of respondents said sustainability, down from 40% in 2022. Instead, manufacturing firms are prioritising securing new business: 37.62% said they were planning to invest in reaching new markets and market expansion, while 36.63% said they wanted to develop their products and services.

Always right

It might be customer service that makes the biggest difference, though: respondents ranked responsiveness and being the first to answer a customer need as the most important factor for their business to be competitive – that’s where rapid prototyping tools and investment in speedy new manufacturing techniques could bear the most fruit.

The industry as a whole is much more prepared for the adoption of Industry 4.0 and digital processes than in previous years: 66% of respondents said their businesses were prepared or very prepared, and only 11% said they were unprepared or very unprepared, down from 34% in 2022, and 38% in 2021

The level of automation has also increased: last year, 56% of respondents said less than a quarter of their manufacturing services were automated, but only 35% say the same in 2023. Cost pressures may cause that automation to slow down in the short term: 40% said they expect automation to increase only a little or not at all over the next 12 months, but, over a longer timescale, 40% think it will increase a lot over the next five years.

Skills challenge

If that’s going to happen, our respondents believe skills will be paramount. We asked them what UK companies need to do to retain their position in global manufacturing and 70% said a greater focus on and investment in STEM talent in the manufacturing and industrial sector would be key. Second on the list was embracing Industry 4.0 by using big data to create value-added services. And third was more support from government: in the aftermath of Brexit, companies have been asking for greater support to help develop industries in the UK.

But the biggest challenge to adopting new digital manufacturing technologies is now cost, say respondents, followed by time, lack of awareness and expertise. Hopes were high, however. One respondent said it would “improve quality, reduce downtime and enable new techniques”. Another said it would “make production efficiency higher and reduce labour costs,” although there were also concerns about cyber security and how to blend new tech with old.

That’s a key challenge for the industry emerging from our latest survey of the UK manufacturing industry. Digital technologies have much promise and companies are aware of the benefits, but, as in previous years, our research has found that not all of them have the skills and expertise to implement and take advantage of the efficiency and sustainability benefits. Now, with rising costs, manufacturers are in survival mode, forced to focus on the bottom line. The need to adapt and adopt new technologies has never been greater.